IRS Audit Representation in Houston, TX

Use your right to IRS audit representation in Houston, TX

Have you received an IRS notice that says they want to examine some items on your tax return? Chances are, they have found discrepancies in what you have filed. The worst thing about an IRS audit is that it places a burden of additional money owed in most cases. Why? Whether you are an ordinary citizen or a business owner, you may not have enough resources to deal with the paperwork while providing evidence for the items reported. But, like all taxpayers out there, you are entitled to IRS tax audit representation that can take the hassle out of the process.

If you are looking to be professionally represented before the IRS, Collins Legal can help. Having our team of IRS audit attorneys in your corner saves you the trouble of addressing those requests or collecting documentation. We will handle the process from A to Z, all while making sure you do not have to fret about anything.

We are dedicated to tirelessly fighting for the best outcome in your audit situation. And once we get to know more about it, we will start building your comprehensive defense strategy.

What makes your ideal IRS tax audit help strategy?

No two tax returns are alike. That is why scrutinizing your numbers is the first step we will take during your IRS audit representation in Houston, TX. Our attorneys will thoroughly study your situation and double-check everything you have reported as an individual or a business owner.

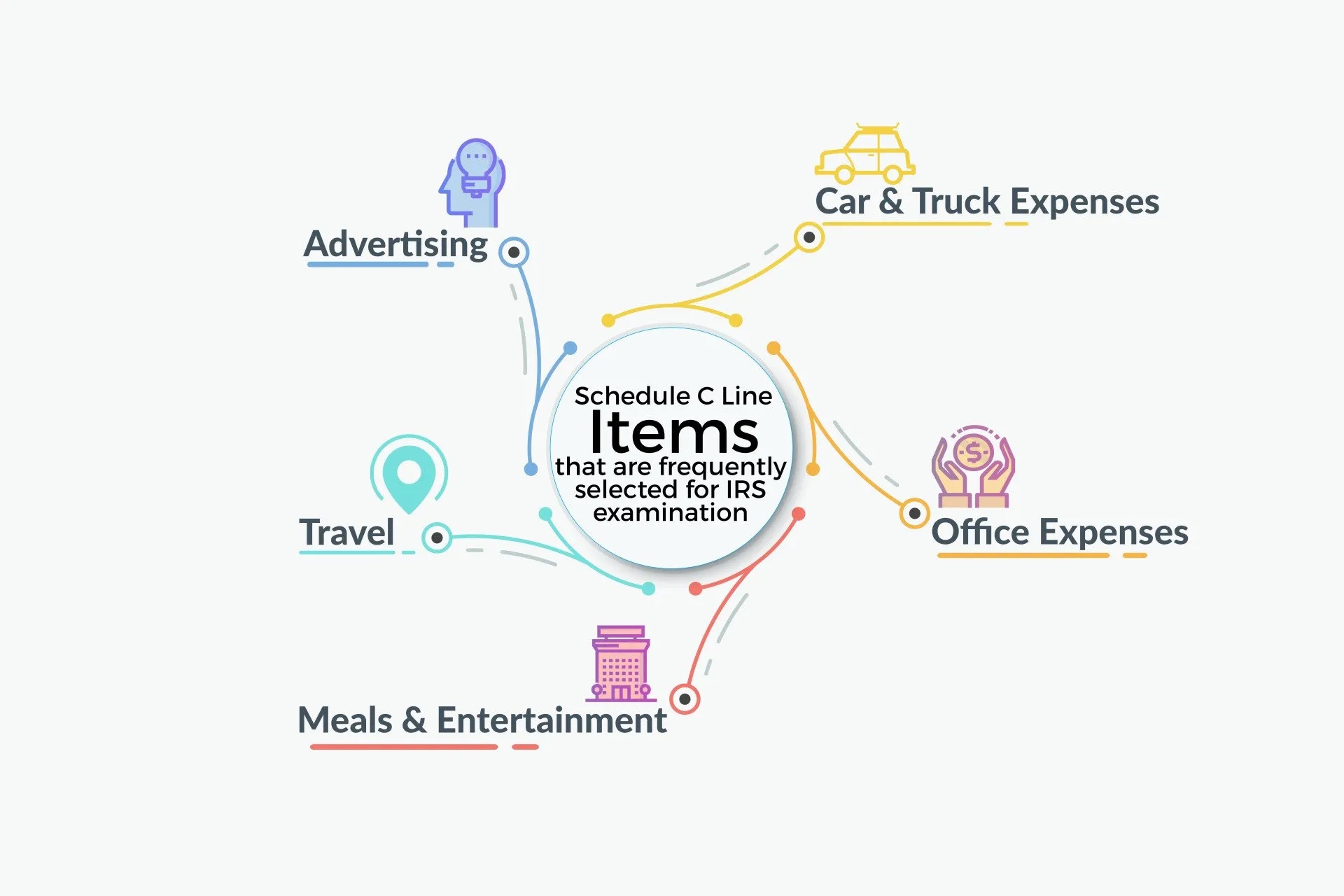

The next step depends on the items being examined by the IRS. If you are self-employed, you will likely be facing an audit of your travel, advertising, entertainment, office, or car expenses. They will want you to prove the numbers with a slew of documents and records. But do not worry. Our IRS audit attorneys will collect them and prepare everything else to adequately represent you.

When standing up for you, we will also:

- formulate responses to IRS questions

- handle all the correspondence

- provide the IRS with tax-related information on your behalf

- make sure you are not giving them more records than needed to prove your numbers

- work out the most optimal solution in your audit situation

More than just tax help with IRS audits

With our comprehensive defense strategy, we do not only protect you while the IRS is examining your information. Besides that, we help you become more well-versed in planning, filing, refund claiming, and other tax matters. Ignorance is not bliss when it comes to money.

Get professional IRS audit help in Houston with Collins Legal. Use the form on your right to request a consultation and smooth out the examination period.

The Internal Revenue Service is one of the most feared government agencies. For this reason, many people are not as confident in their accounting practices as they should be.

An IRS audit represents an opportunity for the IRS to confirm that all of your income has been reported accurately and that you have paid the correct amount of taxes. If there are any discrepancies found, you will receive a bill for the additional taxes owed.

However, it may be possible to avoid an IRS audit if you hire a professional tax firm to represent you during your audit representation in Houston, TX.

Some services that these professionals offer are: Tax Preparation and Planning Services – Helping individuals and business owners manage their tax liabilities by advising them on tax law changes before they happen; Tax Litigation Services – Representing clients with IRS audits.

In what cases will the IRS audit a tax return?

The IRS will audit a tax return if they think that the taxpayer is trying to commit fraud or if they believe the taxpayer’s return is not accurate. If the IRS finds an error, they will send a notice and ask for more information.

How is the process different from a standard audit?

A standard audit is usually done by an auditor who is trained to review a company’s financial statements and other records. They are usually hired by the company that they are auditing, or at least have some form of authority from them.

An external audit is often conducted by a third party who has no affiliation with the company that they are auditing. This means that they can provide an unbiased opinion on how the company is doing financially.

The process of an external audit is different because it focuses more on financial statements and less on other records. They also focus more on compliance with regulations than a standard audit would do.

What’s the best way to prepare for an audit?

Audits are a way for companies to make sure that they are following the best practices and laws. They also provide an opportunity for the company to improve, which is always a good thing.

The best way to prepare for an audit is by making sure that you have all of your documents in order and that you have a system in place. You should also know what information is required by the auditors and how to respond if they ask any questions.

I’ve been audited, how do I get my money back?

Audit, audit process, audit process in India, what is an audit?

Audits are conducted by a company’s third-party auditor to check the company’s financial records and ensure that they are accurate. The auditor checks whether the company has complied with the accounting standards set by the government. Audits are a necessary step in any business because they provide assurance to investors, creditors and other stakeholders that the company is adequately managing its finances.

What are the penalties for not filing taxes when required to do so?

The penalties for not filing taxes when required to do so are as follows:

If you fail to file a tax return, the Internal Revenue Service (IRS) will notify you by mail that you owe taxes. If you still do not file, the IRS will charge interest on any unpaid taxes and penalties. The IRS may also charge late-filing and late-payment penalties, which can be as high as 25%.

If you are assessed a penalty for filing your tax return more than 60 days after the due date or extended due date, there is an additional penalty of 5% per month up to a maximum of 25%.

If you do not pay your balance in full by the date in the notice, the IRS will charge a late payment penalty of 0.5% per